Discounted Cash Flow (DCF) — your financial time machine

2024-03-05

Last update on 2024-03-05

A comprehensive description of the Discounted Cash Flow (DCF) analysis based on Weighted Average Cost of Capital (WACC).

Picture this: You've got a crystal ball that can help you see the future cash flows of an investment, and you want to know how much they're worth today. That's where Discounted Cash Flow (DCF) analysis with the Weighted Average Cost of Capital (WACC) comes in. It's like a financial time machine that calculates the present value of future money, factoring in the cost of capital for both debt and equity. DCF via WACC is your secret weapon for finding out if an investment is a hidden treasure or a financial dud.

In this article, we're your backstage ticket to mastering DCF via WACC. We`ll guide you through the crucial components like future cash flows, the magic of discounting, and the all-important WACC. But that's not all!

The real gem is that marketstorylabs.com does the work for you. No more tedious number-crunching or complex calculations. Here, you get everything you need to effortlessly and accurately perform DCF via WACC.

Let's Start!

Calculate BETA

Beta (β) is a measure of a stock sensitivity to overall market movements, specifically to the movements of a benchmark market index like the S&P500. A detailed introduction to Beta you will find in a previous article.

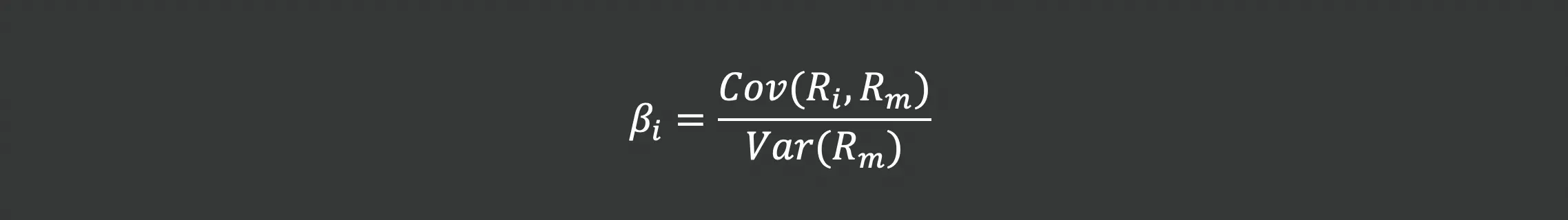

You can calculate Beta as follows:

Covariance(Ri,Rm) is the covariance between the returns of the stock or investment (Ri) and the returns of the market (Rm).

Variance(Rm) is the variance of the market returns.

Remember Beta is often used as a risk measure. Assets with higher beta values are considered riskier because they can experience larger price fluctuations, both upward and downward, in response to market movements.

Market Premimum

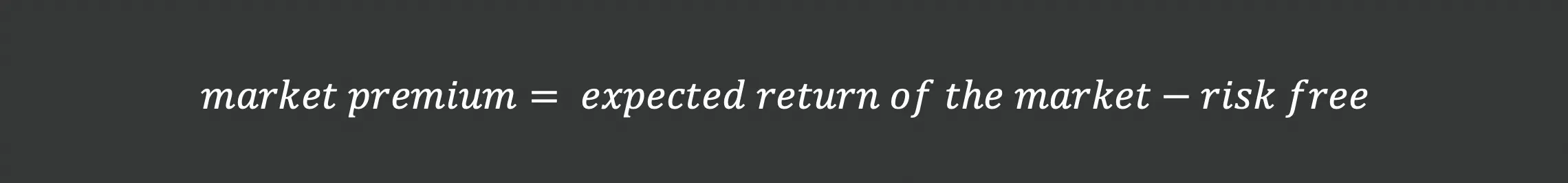

Market Premium represents the additional return that investors expect to earn above the risk-free rate of return as compensation for taking on the risk associated with investing in the overall stock market or a specific equity investment. For example you know that the 5 year average return on the S&P 500 is 11.8% and a risk free investment is considered as 4%. Your market premium is 7.8%

The equation is the following:

A risk free investment is considered as 10 Year US-Treasury-Bond and the current yield is 4.3 in September 2023. The expected return of the market is considered as the 5-year average yield of the S&P500 that is 11.8%

Capital Asset Pricing Model (CAPM)

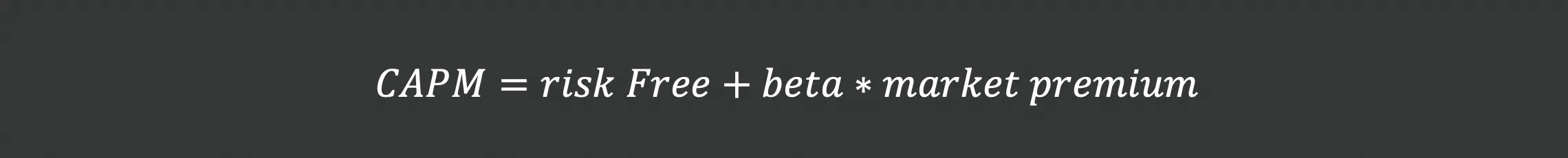

CAPM is used to estimate the expected return on an investment based on its risk. It posits that the expected return of an asset is equal to the risk-free rate plus a risk premium that is proportional to the asset's beta coefficient, a measure of its systematic risk. In simpler terms, CAPM helps investors assess whether an investment's potential return justifies the risk they are taking compared to a risk-free investment like government bonds.

You can calulate:

It usually represents the the estimate for the cost of equity.

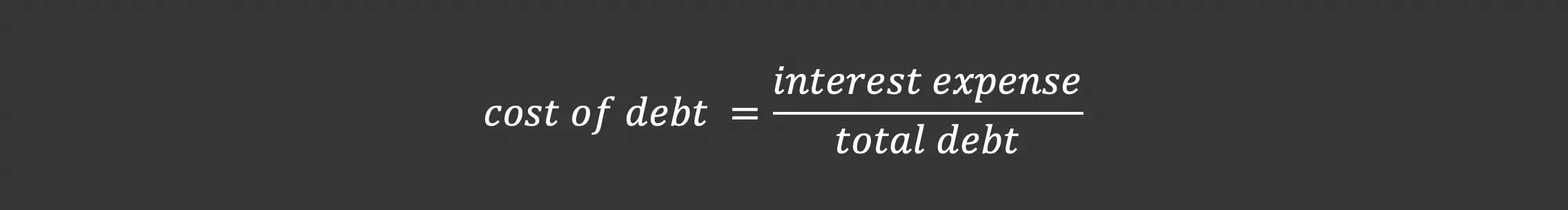

Cost of Debt

The cost of debt is the interest rate a company pays on its debt, such as bonds or loans. It represents the effective interest rate a company pays on its debt obligations. It is a crucial component of a company's overall cost of capital, which is used to assess the feasibility of investment projects.

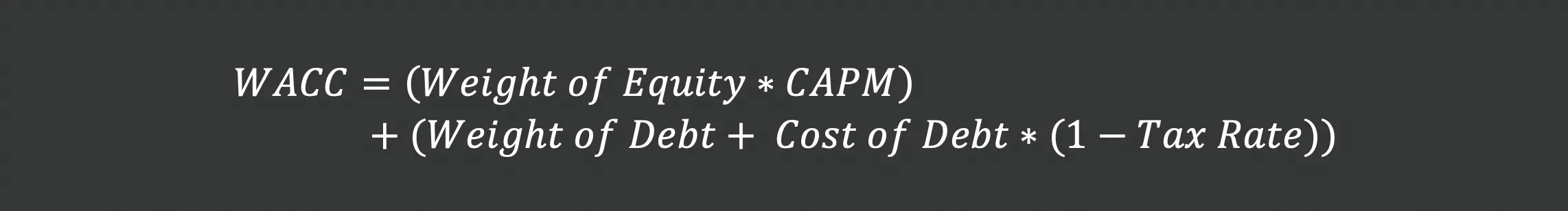

Weighted Average Cost of Capital (WACC)

The Weighted Average Cost of Capital (WACC) is a financial metric that represents the average cost of all the sources of capital a company uses to finance its operations. It takes into account the cost of equity, cost of debt, and cost of any other financing sources, such as preferred stock or retained earnings. WACC is calculated by assigning weights to each source of capital based on their proportion in the company's capital structure. These weights reflect the relative importance of each source in the company's overall financing. WACC is a critical tool for evaluating the feasibility of investment projects and helps determine if the expected returns on investments exceed the cost of capital, which is necessary for value creation for shareholders.

It is often used as a discount rate for evaluating the present value of future cash flows in financial decision-making.

- Weight of Equity - is the proportion of a company's total capital structure that is funded by equity

- CAPM - the cost of equity is related to CAPM and is a commonly used method for estimating the cost of equity

- Weight of Debt - the proportion of a company's total capital structure that is funded by debt

- Cost of Debt - the effective interest rate a company pays on its debt obligations, representing the expense incurred by the company for using debt financing

- Tax Rate - is the percentage of a company's profits that it must pay in taxes to the government

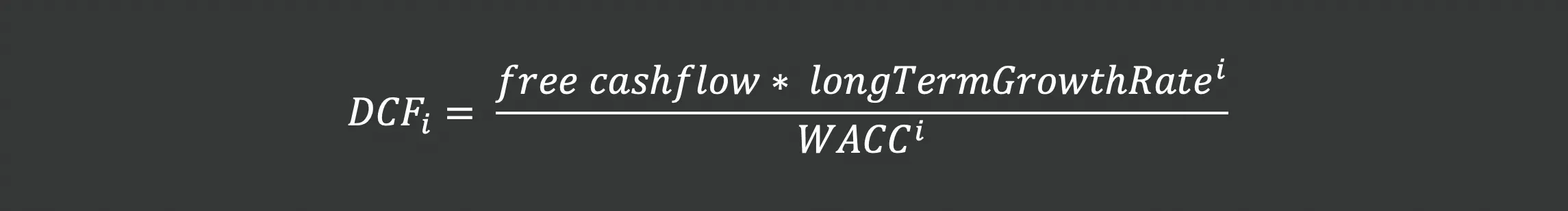

Discounted Cashflow (DCF)

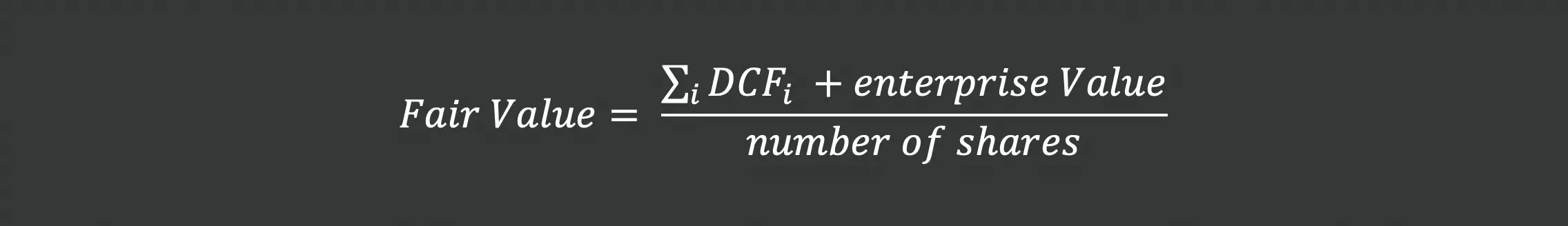

The Discounted Cash Flow (DCF) analysis using the Weighted Average Cost of Capital (WACC) is a fundamental financial valuation method used to determine the intrinsic value of an investment or business. It relies on projecting future cash flows, discounting them back to their present value using the company's WACC, which accounts for both the cost of debt and equity in the capital structure. DCF via WACC is based on the principle that the value of money today is worth more than the same amount in the future, considering the opportunity cost of capital. By comparing the present value of future cash flows with the initial investment or purchase price, DCF via WACC helps investors assess whether an investment is undervalued or overvalued, aiding in sound financial decision-making. It's widely used in corporate finance, investment analysis, and mergers and acquisitions to guide investment choices.

- Free Cashflow - is the free cashflow of the company

- Longterm Growth Rate - is the Compound Annual Growth Rate (CAGR) of the earnings per share but can be as well a fixed value like 5%

- WACC - is the Weighted Average Cost of Capital

To calculate the fair value you have to divide the result with the existing number of shares:

Let's face it, Discounted Cash Flow (DCF) analysis can be a real brain-twister. Crunching numbers, wrestling with spreadsheets, and navigating complex financial equations can make anyone's head spin. But guess what? You don't have to wrestle with those financial puzzles anymore, because we've got a game-changer for you.

DCF might be tough, but it doesn't have to be. Say hello to marketstorylabs.com, your financial superhero! This platform takes the hassle out of DCF calculations and makes the complex seem simple.

Right now we have calculated all companies of the S&P500 (others follow soon).

Conclusion

In this article, we've dived deep into the nitty-gritty of crunching numbers for the Discounted Cash Flow (DCF) analysis via the Weighted Average Cost of Capital (WACC) method. You've mastered the art of estimating fair values for investments and businesses, but guess what? No need to break a sweat over those complex calculations any longer. Marketstorylabs.com is your financial cruncher's dream come true. This powerful platform takes the heavy lifting out of DCF, making it as easy as pie to evaluate investments and businesses.

Start on your path to financial success by exploring the world of stocks on marketstorylabs.com - simple, proficient, and free.

Obligatory risk notice

We would like to point out that the contents of this website are for general information purposes only and do not constitute recommendations for the purchase or sale of specific financial instruments, and therefore do not constitute investment advice. In particular, marketstorylabs.com and its creators cannot assess the extent to which information / recommendations made on the pages correspond to your investment objectives, your risk tolerance and your ability to bear losses. Therefore, if you make any investment decisions based on information on the site, you do so solely on your own responsibility and at your own risk. This in turn means that neither marketstorylabs.com nor its creators are liable for any losses incurred as a result of investment decisions based on the information on the marketstorylabs.com website or other media used.